E-Bilty in Pakistan: A Step Towards Digital Transformation in the Transport Sector

E-Bilty in Pakistan: An Advancement in the Transportation Sector’s Digital Transformation

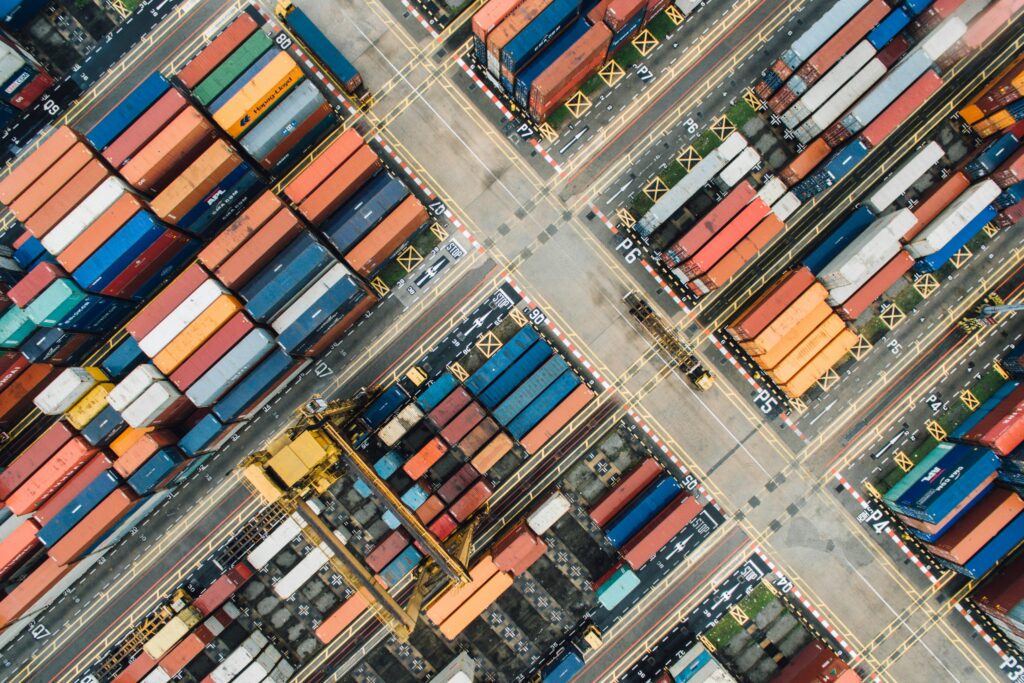

With millions of shipments passing through Pakistan every day, the transportation and logistics industry is essential to the nation’s economy. A bilty, a paper-based consignment note that acts as evidence of the movement of commodities from one location to another, is typically used to record each of these consignments. However, Pakistan has started moving towards a contemporary and transparent system called as E-Bilty in response to mounting concerns about tax evasion, document fraud, and inefficiencies.

What is E-Bilty

A digital variant of the conventional paper bilty is called Electronic Bilty, or E-Bilty. It is electronically filed to the relevant tax authorities, such as the Punjab Revenue authorities (PRA), after being issued online by the transporter or goods carrier. Complete information on the products being delivered, the sender and recipient, the route, the vehicle number, and tax compliance data are all included in this digital document.

E-Bilty wants to improve the efficiency, transparency, and tax compliance of the transportation industry by substituting an automated system for handwritten documentation.

Why is E-Bilty Important?

The manual bilty system had a number of shortcomings, including:

Absence of a centralised record

Simple document loss or manipulation

Inability to track down authorities

Frequently underreporting in order to evade taxes

Real-time data reporting and digital traceability are two ways that the E-Bilty system tackles these issues. Every electronically issued bilty is added to the government’s digital records, which helps tax agencies keep an eye on the flow of commodities and stop tax leaks.

Benefits of E-Bilty

The use of E-Bilty has a number of advantages for transportation providers, businesses, and government agencies:

✅ Improved Tax Compliance: Ensures that all goods movements are properly recorded and taxed.

✅ Digital Records: Businesses no longer need to store and manage piles of paper bilties.

✅ Time Efficiency: Fast generation and submission of bilties via online portals. Transparency lowers the likelihood of manipulation and fraud. Integration: Straightforward integration with the GST and sales tax systems

Pakistan’s current implementation

Through the Punjab Revenue Authority, the E-Bilty system has already been implemented by the Punjab government. For each shipment, businesses transporting taxable goods are required to register and produce E-Bilty documents. Failure to do so may result in penalties or seizure of goods.

To help the industry adapt, the government is also offering training workshops, helplines, and online portals to facilitate the transition. With time, similar systems are expected to be implemented across other provinces as well.

Conclusion

The introduction of E-Bilty in Pakistan marks a significant step toward the digital transformation of the transport sector. It not only ensures better tax collection and transparency but also encourages businesses to embrace digital practices. As the country moves towards a more digital economy, systems like E-Bilty are essential in laying the foundation for sustainable growth and modern governance.